Anticipate announcing preliminary Phase 1b safety and efficacy data for pan-BD BET inhibitor, VYN201, in nonsegmental vitiligo in Q3 2023

IND-enabling studies for VYN202, a potential best-in-class oral small molecule BD2-selective BET inhibitor, are ongoing in anticipation of indication selection in Q4 2023 and initiating a Phase 1 trial in Q1 2024

BRIDGEWATER, N.J., Aug. 14, 2023 (GLOBE NEWSWIRE) — VYNE Therapeutics Inc. (Nasdaq: VYNE) (“VYNE” or the “Company”), a clinical-stage biopharmaceutical company focused on developing proprietary, innovative and differentiated therapies for the treatment of immuno-inflammatory conditions, today announced financial results for the three and six months ended June 30, 2023 and provided a business update.

“We continue to make excellent progress in advancing our two novel small molecule BET inhibitors, VYN201 and VYN202, for the treatment of immuno-inflammatory conditions,” said David Domzalski, President and Chief Executive Officer of VYNE. “As we prepare to report the first clinical trial results for VYN201 in patients with non-segmental vitiligo later this quarter, we are pleased by the compound’s positive safety profile and pharmacokinetics results in healthy volunteers that we reported in the first quarter. Taken together, the Phase 1a data and the consistent results observed across multiple preclinical models of VYN201 suggest that BET inhibition has the potential to be an effective new treatment approach to address several immuno-inflammatory diseases, including vitiligo. We are also making steady progress in our IND-enabling studies for our first oral BET inhibitor, VYN202, and anticipate selection of a lead indication in the fourth quarter of 2023 followed by the initiation of clinical testing in the first quarter of 2024.”

Recent Business Updates

VYN201, a locally-administered pan-BD BET inhibitor:

- Upcoming safety and efficacy data readout in Phase 1b trial of vitiligo patients. The Company expects to report preliminary Phase 1b data in the third quarter of 2023, followed by final results in October 2023. The Phase 1a clinical results for VYN201 showed a positive safety profile, with no reported serious adverse events, dose adjustments, clinically relevant treatment emergent adverse events, abnormal clinical laboratory results, electrocardiogram findings or patient withdrawals from the trial. Furthermore, VYN201 showed minimal systemic exposure and all hematological parameters, including platelet counts, were within normal ranges in the Phase 1a portion of the trial.

VYN202, an oral small molecule BD2-selective BET inhibitor:

- IND submission for VYN202 expected by year-end. IND-enabling studies are ongoing, and the Company intends to select a lead indication in the fourth quarter of 2023. The IND submission for VYN202 is expected by year-end in anticipation of commencing a Phase 1 trial in the first quarter of 2024.

- On May 1, 2023, the Company announced selection of a lead development candidate, VYN202, a potential best-in-class oral small molecule BD2-selective BET inhibitor for the treatment of immuno-inflammatory conditions. The lead candidate was chosen from a library of BD2-selective BET inhibitors based on a robust package of encouraging preclinical data developed from a series of well-validated animal models in various autoimmune disorders.

*See “Non-GAAP Financial Measure” elsewhere in this earnings release.

Liquidity and Capital Resources

As of June 30, 2023, VYNE had cash and cash equivalents and restricted cash of $20.7 million. VYNE currently anticipates that its cash and cash equivalents and restricted cash as of June 30, 2023 will be sufficient to fund its operations through the end of 2023, without giving effect to any potential business development transactions or financing activities, including any sales under its equity line of credit with Lincoln Park or the Company’s at-the-market offering program. See Note 1 to VYNE’s unaudited interim condensed consolidated financial statements included in VYNE’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2023 for additional discussion on liquidity and capital resources.

Financial Results for the Second Quarter Ended June 30, 2023

Revenues. Revenues totaled $0.1 million for each of the quarters ended June 30, 2023 and 2022, consisting of royalty revenue.

Research and development expenses. VYNE’s research and development expenses for the quarter ended June 30, 2023 were $7.2 million, as compared to $4.1 million for the comparable period in 2022. The increase was primarily driven by expenses related to the development of VYN202, including the payment made in connection with entering into the VYN202 License Agreement. This increase was partially offset by lower employee-related expenses and decreased spending for FMX114.

Selling, general and administrative expenses. VYNE’s selling, general and administrative expenses for the quarter ended June 30, 2023 were $3.2 million, compared to $4.3 million for the comparable period in 2022. The decrease was primarily driven by decreased consulting and professional fees and lower rent and corporate insurance expenses.

Net loss. Net loss and net loss per share for the quarter ended June 30, 2023 was $10.1 million and $3.09, respectively, compared to a net loss and net loss per share of $8.5 million and $2.63 for the comparable period in 2022, respectively. Net loss reported for the second quarter of 2022 reflected the impact of $0.2 million from discontinued operations, net of income taxes.

About VYNE Therapeutics Inc.

VYNE’s mission is to improve the lives of patients by developing proprietary, innovative and differentiated therapies for the treatment of immuno-inflammatory conditions. The Company’s unique and proprietary bromodomain & extra-terminal (BET) domain inhibitors, which comprise its InhiBET™ platform, include a locally administered pan-BET inhibitor (VYN201) and an orally available BD2-selective BET inhibitor (VYN202) that were licensed from Tay Therapeutics Limited.

For more information about VYNE Therapeutics Inc. or its product candidates, visit www.vynetherapeutics.com. VYNE may use its website to comply with its disclosure obligations under Regulation FD. Therefore, investors should monitor VYNE’s website in addition to following its press releases, filings with the U.S. Securities and Exchange Commission, public conference calls, and webcasts.

Investor Relations:

John Fraunces

LifeSci Advisors, LLC

917-355-2395

jfraunces@lifesciadvisors.com

Tyler Zeronda

VYNE Therapeutics Inc.

908-458-9106

Tyler.Zeronda@VYNEtx.com

Cautionary Statement Regarding Forward-Looking Statements

This release includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, but not limited to, statements regarding VYNE’s timing for announcing Phase 1b data for VYN201, VYNE’s plans, regulatory filings and development timelines for VYN202, VYNE’s InhiBET™ platform, VYNE’s ability to fund its operations through the end of 2023 and other statements regarding the future expectations, plans and prospects of VYNE. All statements in this press release which are not historical facts are forward-looking statements. Any forward-looking statements are based on VYNE’s current knowledge and its present beliefs and expectations regarding possible future events and are subject to risks, uncertainties and assumptions that could cause actual results to differ materially and adversely from those set forth or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to: VYNE’s ability to successfully develop its product candidates; the timing of the commencement of future non-clinical studies and clinical trials; VYNE’s ability to enroll patients and successfully progress, complete, and receive favorable results in clinical trials for its product candidates; VYNE’s intentions and its ability to obtain additional funding, either through equity or debt financing transactions or collaboration arrangements; VYNE’s ability to comply with various regulations applicable to its business; VYNE’s ability to create intellectual property and the scope of protection it is able to establish and maintain for intellectual property rights covering its product candidates, including the projected terms of patent protection; risks that any of VYNE’s patents may be held to be narrowed, invalid or unenforceable or one or more of VYNE’s patent applications may not be granted and potential competitors may also seek to design around VYNE’s granted patents or patent applications; estimates of VYNE’s expenses, capital requirements, its needs for additional financing and its ability to obtain additional capital on acceptable terms or at all; VYNE’s expectations regarding licensing, business transactions and strategic operations; VYNE’s future financial performance and liquidity; and potential volatility in VYNE’s stock price that may result in rapid and substantial increases or decreases in the stock price that may or may not be related to VYNE’s operating performance or prospects. For a discussion of other risks and uncertainties, and other important factors, any of which could cause VYNE’s actual results to differ from those contained in the forward-looking statements, see the section titled “Risk Factors” in VYNE’s Annual Report on Form 10-K for the year ended December 31, 2022, VYNE’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2023, as well as discussions of potential risks, uncertainties, and other important factors in VYNE’s subsequent filings with the U.S. Securities and Exchange Commission. Although VYNE believes these forward-looking statements are reasonable, they speak only as of the date of this announcement and VYNE undertakes no obligation to update publicly such forward-looking statements to reflect subsequent events or circumstances, except as otherwise required by law. Given these risks and uncertainties, you should not rely upon forward-looking statements as predictions of future events.

| VYNE THERAPEUTICS INC. CONDENSED CONSOLIDATED BALANCE SHEETS (U.S. dollars in thousands, except share and per share data) (Unaudited) |

|||||||

| June 30, | December 31 | ||||||

| 2023 | 2022 | ||||||

| Assets | |||||||

| Current Assets: | |||||||

| Cash and cash equivalents | $ | 20,634 | $ | 30,908 | |||

| Restricted cash | 67 | 67 | |||||

| Trade receivables, net of allowances | 234 | 173 | |||||

| Amount due from sale of MST Franchise | — | 5,000 | |||||

| Prepaid and other expenses | 2,024 | 2,127 | |||||

| Total Current Assets | 22,959 | 38,275 | |||||

| Non-current prepaid expenses and other assets | 2,000 | 2,483 | |||||

| Total Assets | $ | 24,959 | $ | 40,758 | |||

| Liabilities, Mezzanine Equity and Stockholders’ Equity | |||||||

| Current Liabilities: | |||||||

| Trade payables | $ | 1,159 | $ | 2,386 | |||

| Accrued expenses | 4,379 | 4,381 | |||||

| Employee related obligations | 836 | 2,372 | |||||

| Liability for employee severance benefits | — | 206 | |||||

| Total Current Liabilities | 6,374 | 9,345 | |||||

| Other liabilities | 1,313 | — | |||||

| Total Liabilities | 7,687 | 9,345 | |||||

| Commitments and Contingencies | |||||||

| Mezzanine Equity: | |||||||

| Convertible Preferred Stock: $0.0001 par value; 20,000,000 shares authorized at June 30, 2023 and December 31, 2022; Series A Preferred Stock: 0 and 3,000 shares issued and outstanding at June 30, 2023 and December 31, 2022, respectively | — | 211 | |||||

| Stockholders’ Equity: | |||||||

| Common stock: $0.0001 par value; 150,000,000 shares authorized at June 30, 2023 and December 31, 2022; 3,282,479 and 3,229,704 shares issued and outstanding at June 30, 2023 and December 31, 2022, respectively | — | — | |||||

| Additional paid-in capital | 695,836 | 693,937 | |||||

| Accumulated deficit | (678,564 | ) | (662,735 | ) | |||

| Total Stockholders’ Equity | 17,272 | 31,202 | |||||

| Total Liabilities, Mezzanine Equity and Stockholders’ Equity | $ | 24,959 | $ | 40,758 | |||

| VYNE THERAPEUTICS INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (U.S. dollars in thousands, except per share data) (Unaudited) |

|||||||||||||||

| Three Months Ended June 30 | Six Months Ended June 30 | ||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||

| Revenues | |||||||||||||||

| Royalty revenues | $ | 135 | $ | 126 | $ | 234 | $ | 304 | |||||||

| Total revenues | 135 | 126 | 234 | 304 | |||||||||||

| Operating expenses: | |||||||||||||||

| Research and development | 7,233 | 4,108 | 9,967 | 8,560 | |||||||||||

| Selling, general and administrative | 3,220 | 4,305 | 6,460 | 8,722 | |||||||||||

| Total operating expenses | 10,453 | 8,413 | 16,427 | 17,282 | |||||||||||

| Operating loss | (10,318 | ) | (8,287 | ) | (16,193 | ) | (16,978 | ) | |||||||

| Other income, net | 280 | 52 | 543 | 49 | |||||||||||

| Loss from continuing operations before income taxes | (10,038 | ) | (8,235 | ) | (15,650 | ) | (16,929 | ) | |||||||

| Income tax expense | — | — | — | — | |||||||||||

| Loss from continuing operations | (10,038 | ) | $ | (8,235 | ) | (15,650 | ) | (16,929 | ) | ||||||

| (Loss) income from discontinued operations, net of income taxes | (20 | ) | (241 | ) | (30 | ) | 13,123 | ||||||||

| Net loss | $ | (10,058 | ) | $ | (8,476 | ) | $ | (15,680 | ) | $ | (3,806 | ) | |||

| Loss per share from continuing operations, basic and diluted | $ | (3.08 | ) | $ | (2.56 | ) | $ | (4.81 | ) | $ | (5.38 | ) | |||

| (Loss) income per share from discontinued operations, basic and diluted | $ | (0.01 | ) | $ | (0.07 | ) | $ | (0.01 | ) | $ | 4.17 | ||||

| Loss per share, basic and diluted | $ | (3.09 | ) | $ | (2.63 | ) | $ | (4.82 | ) | $ | (1.21 | ) | |||

| Weighted average shares outstanding – basic and diluted | 3,274 | 3,218 | 3,265 | 3,148 | |||||||||||

Non-GAAP Financial Measures

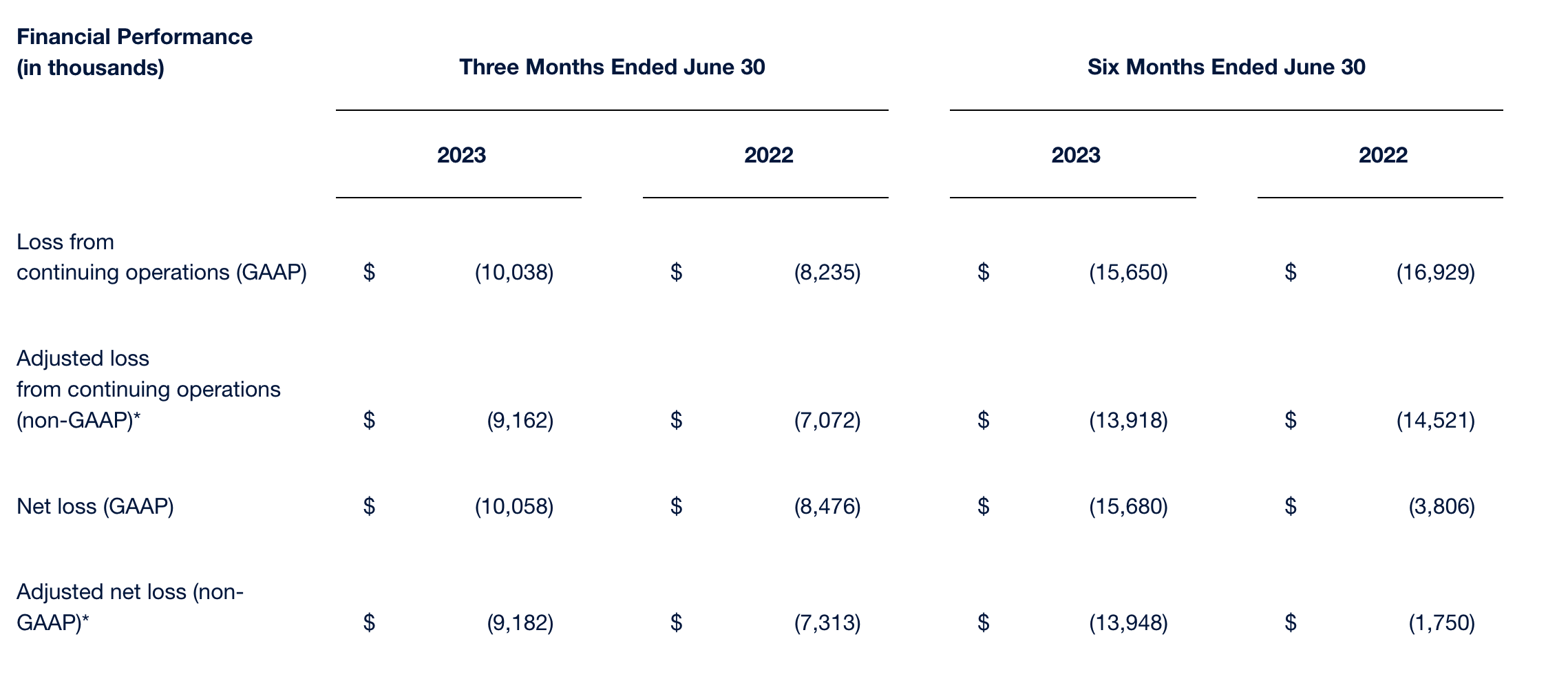

In evaluating the operating performance of its business, VYNE’s management considers adjusted net loss, adjusted net loss per share, adjusted loss from continuing operations, adjusted total operating expenses (including adjusted research and development expense and adjusted selling, general and administrative expense), adjusted operating loss and adjusted loss per share from continuing operations. These non-GAAP financial measures exclude stock-based compensation charges that are required by GAAP. The Company believes that these non-GAAP financial measures provide management, analysts, investors and other users of the Company’s financial information with meaningful supplemental information regarding the performance of the Company’s business by excluding the effect of certain non-cash expenses and items that VYNE believes may not be indicative of its operating performance, because they are either unusual and VYNE does not expect them to recur in the ordinary course of its business, or they are unrelated to the ongoing operation of the business in the ordinary course. These non-GAAP financial measures should not be considered superior to, but rather in addition to, other financial measures prepared by the Company in accordance with GAAP, including the period-to-period results. The Company’s method of determining these non-GAAP financial measures may be different from other companies’ methods and, therefore, may not be comparable to those used by other companies, and the Company does not recommend the sole use of these non-GAAP measures to assess its financial and earnings performance. For reasons noted above, the Company is presenting certain non-GAAP financial measures for the three and six months ended June 30, 2023 and 2022. The following tables reconcile non-GAAP financial measures presented in this press release.

The following tables provides detailed reconciliations of various other income statement data between GAAP and non-GAAP amounts for the three and six months ended June 30, 2023 and 2022 (in thousands, except per share data):

Reconciliation of net loss to adjusted net loss and net loss per share to adjusted net loss per share:

| Three Months Ended June 30 | Six Months Ended June 30 | ||||||||||||||

| (in thousands, except per share data) | 2023 | 2022 | 2023 | 2022 | |||||||||||

| Net loss (GAAP) | $ | (10,058 | ) | $ | (8,476 | ) | $ | (15,680 | ) | $ | (3,806 | ) | |||

| Add-back: stock-based compensation expense | 876 | 1,163 | 1,732 | 2,056 | |||||||||||

| Adjusted net loss (non-GAAP) | $ | (9,182 | ) | $ | (7,313 | ) | $ | (13,948 | ) | $ | (1,750 | ) | |||

| Net loss per share, basic and diluted (GAAP) | $ | (3.09 | ) | $ | (2.63 | ) | $ | (4.82 | ) | $ | (1.21 | ) | |||

| Add-back: stock-based compensation expense | 0.27 | 0.36 | 0.53 | 0.65 | |||||||||||

| Adjusted net loss per share, basic and diluted (non-GAAP) | $ | (2.82 | ) | $ | (2.27 | ) | $ | (4.29 | ) | $ | (0.56 | ) | |||

| Weighted average number of shares outstanding, basic and diluted | 3,274 | 3,218 | 3,265 | 3,148 | |||||||||||

Reconciliation of loss from continuing operations to adjusted loss from continuing operations; research and development expense to adjusted research and development expense; selling, general and administrative expense to adjusted selling, general and administrative expense; total operating expenses to adjusted total operating expenses; operating loss to adjusted operating loss; and loss per share from continuing operations to adjusted loss per share from continuing operations:

| Three Months Ended June 30 | Six Months Ended June 30 | |||||||||||||||

| (in thousands, except per share data) | 2023 | 2022 | 2023 | 2022 | ||||||||||||

| Loss from continuing operations (GAAP) | $ | (10,038 | ) | $ | (8,235 | ) | $ | (15,650 | ) | $ | (16,929 | ) | ||||

| Add-back: stock-based compensation expense | 876 | 1,163 | 1,732 | 2,408 | ||||||||||||

| Adjusted loss from continuing operations (non-GAAP) | $ | (9,162 | ) | $ | (7,072 | ) | $ | (13,918 | ) | $ | (14,521 | ) | ||||

| Research and development expense (GAAP) | $ | 7,233 | $ | 4,108 | $ | 9,967 | $ | 8,560 | ||||||||

| Less: stock-based compensation expense | (138 | ) | (138 | ) | (393 | ) | (182 | ) | (622 | ) | ||||||

| Adjusted research and development expense (non-GAAP) | $ | 7,095 | $ | 3,715 | $ | 9,785 | $ | 7,938 | ||||||||

| Selling, general and administrative expense (GAAP) | $ | 3,220 | $ | 4,305 | $ | 6,460 | $ | 8,722 | ||||||||

| Less: stock-based compensation expense | (738 | (770 | ) | (1,550 | ) | (1,786 | ) | |||||||||

| Adjusted selling, general and administrative expense (non-GAAP) | $ | 2,482 | $ | 3,535 | $ | 4,910 | $ | 6,936 | ||||||||

| Total operating expenses (GAAP) | $ | 10,453 | $ | 8,413 | $ | 16,427 | $ | 17,282 | ||||||||

| Less: stock-based compensation expense | (876 | ) | (1,163 | ) | (1,732 | ) | (2,408 | ) | ||||||||

| Adjusted total operating expenses (non-GAAP) | $ | 9,577 | $ | 7,250 | $ | 14,695 | $ | 14,874 | ||||||||

| Operating loss (GAAP) | $ | (10,318 | ) | $ | (8,287 | ) | $ | (16,193 | ) | $ | (16,978 | ) | ||||

| Add back: stock-based compensation expense | 876 | 1,163 | 1,732 | 2,408 | ||||||||||||

| Adjusted operating loss (non-GAAP) | $ | (9,442 | ) | $ | (7,124 | ) | $ | (14,461 | ) | $ | (14,570 | ) | ||||

| Loss per share from continuing operations, basic and diluted (GAAP) | $ | (3.08 | ) | $ | (2.56 | ) | $ | (4.81 | ) | $ | (5.38 | ) | ||||

| Add back: stock-based compensation expense | 0.27 | 0.36 | 0.53 | 0.76 | ||||||||||||

| Adjusted loss per share from continuing operations, basic and diluted (non-GAAP) | $ | (2.81 | ) | $ | (2.20 | ) | $ | (4.28 | ) | $ | (4.62 | ) | ||||

| Weighted average number of shares outstanding – basic and diluted | 3,274 | 3,218 | 3,265 | 3,148 | ||||||||||||