BRIDGEWATER, N.J., Nov. 05, 2020 (GLOBE NEWSWIRE) — VYNE Therapeutics Inc. (Nasdaq: VYNE) (“VYNE” or the “Company”) today announced financial results for the third quarter ended September 30, 2020 and provided a corporate update.

“The launch of ZILXI® on October 1st means that VYNE now has two commercial products in the dermatology market. Our immediate priorities for ZILXI are to leverage our sales organization and physician experience with AMZEEQ® to drive rapid uptake, and to gain broad payor acceptance and reimbursement,” said David Domzalski, Chief Executive Officer of VYNE. “For AMZEEQ, we are pleased to see that prescriptions have eclipsed pre-COVID levels for the first time since the shut down in March and that the overall market in acne continues to recover.”

Third Quarter and Recent highlights:

- Changed corporate name to VYNE Therapeutics Inc. and our ticker to “VYNE,” effective September 8, 2020.

- ZILXI (minocycline) topical foam, 1.5% for the treatment of inflammatory lesions of rosacea in adults launched and was available in pharmacies nationwide on October 1st.

- First minocycline product of any form to be approved by the FDA for use in rosacea.

- Express Scripts elected to cover ZILXI effective October 2, 2020 on its National Preferred, Flex, and Basic commercial formularies.

- AMZEEQ (minocycline) topical foam, 4% for the treatment of inflammatory lesions of moderate to severe acne vulgaris in adults and patients 9 years of age and older continues to gain market share in acne.

- Prescription volume in Q3 2020 was 32,734, representing 52% growth from Q2 2020.

- Market recovery in acne continues and overall script counts continue to grow.

- Hosted Investor Event: Physician Symposium on October 1st which highlighted the way in which dermatologists use AMZEEQ and plan to use ZILXI in their practices.

- Presenting dermatologists were pleased with the performance of AMZEEQ for their patients and expect to see broad use in acne, and believe ZILXI can quickly become their first in line therapy for rosacea.

- A replay of the event can be accessed on the VYNE Therapeutics website here.

- End of Phase 2 meeting scheduled in Q4 for FCD105.

- Appointed Mr. Patrick G. LePore to serve as a director of the Company.

- Mr. LePore brings more than 40 years of experience in the pharmaceutical industry, in both private and public sectors, and with board and operational experience in each.

* See “Note Regarding the Use of Non-GAAP Financial Measures” elsewhere in this earnings release.

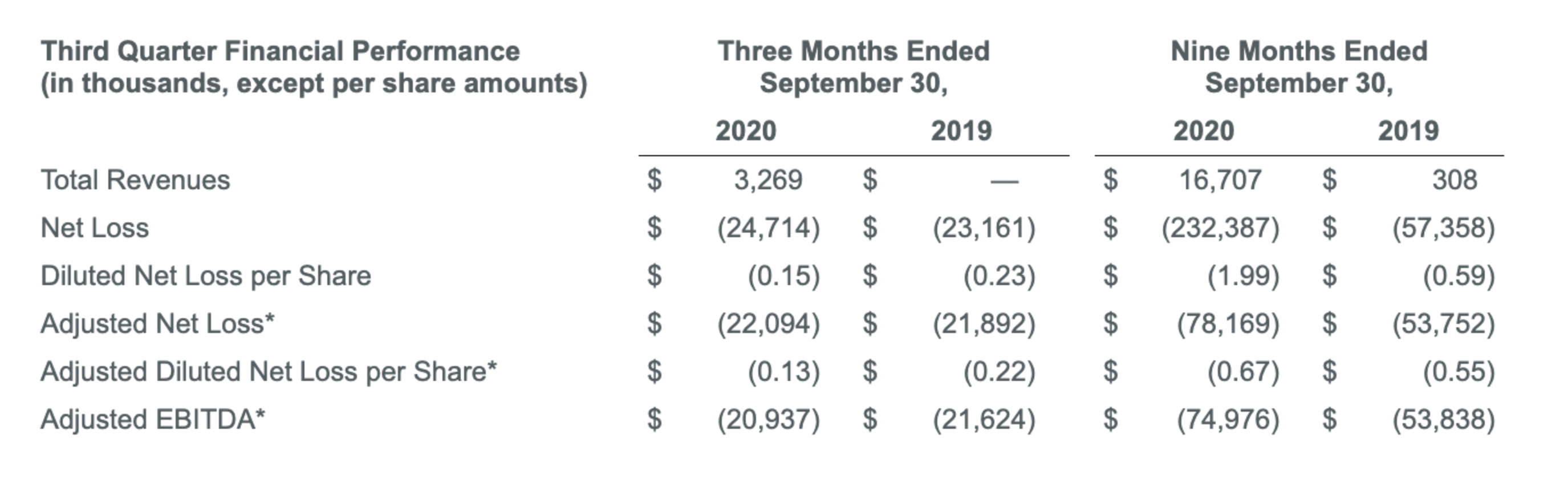

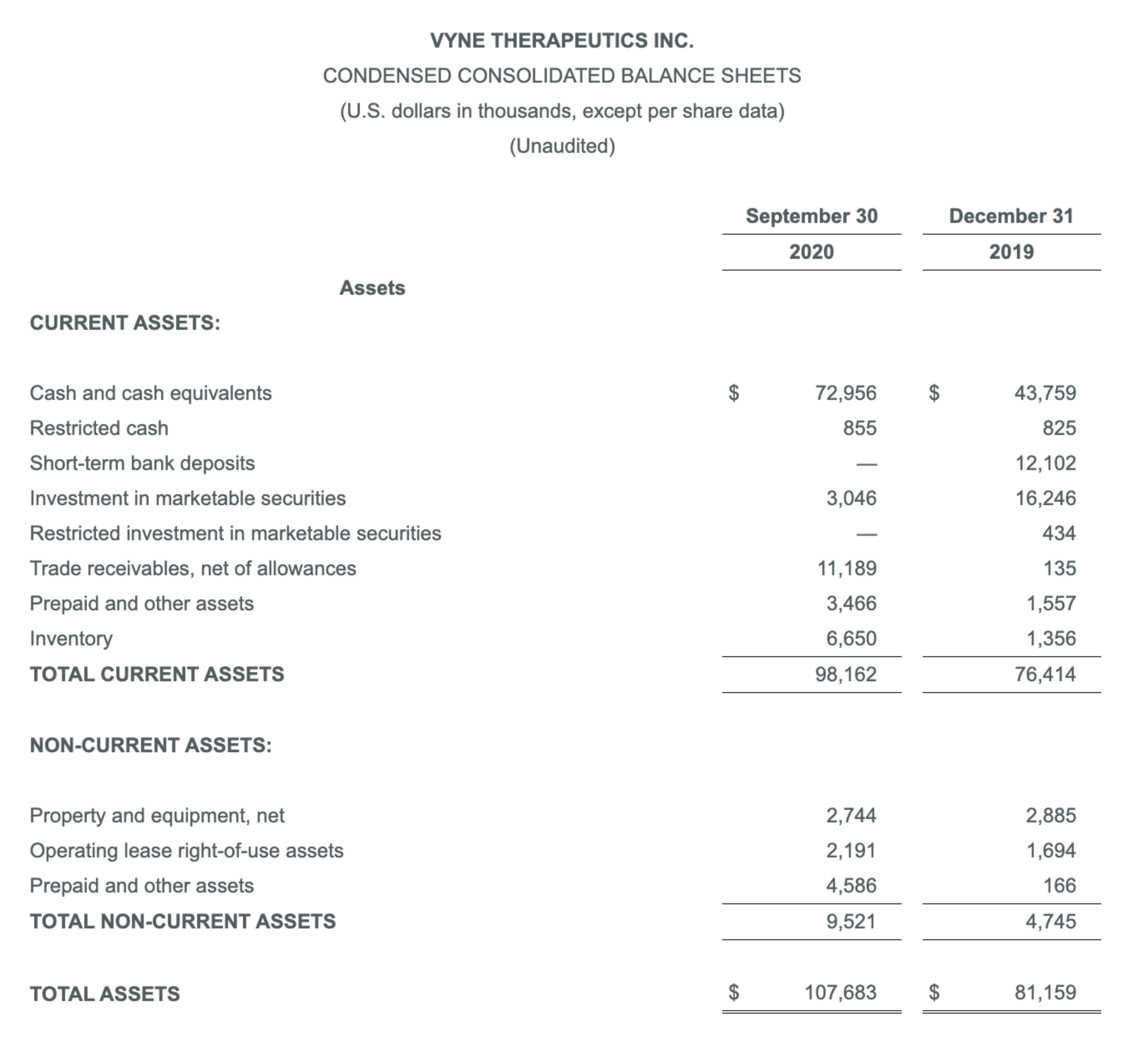

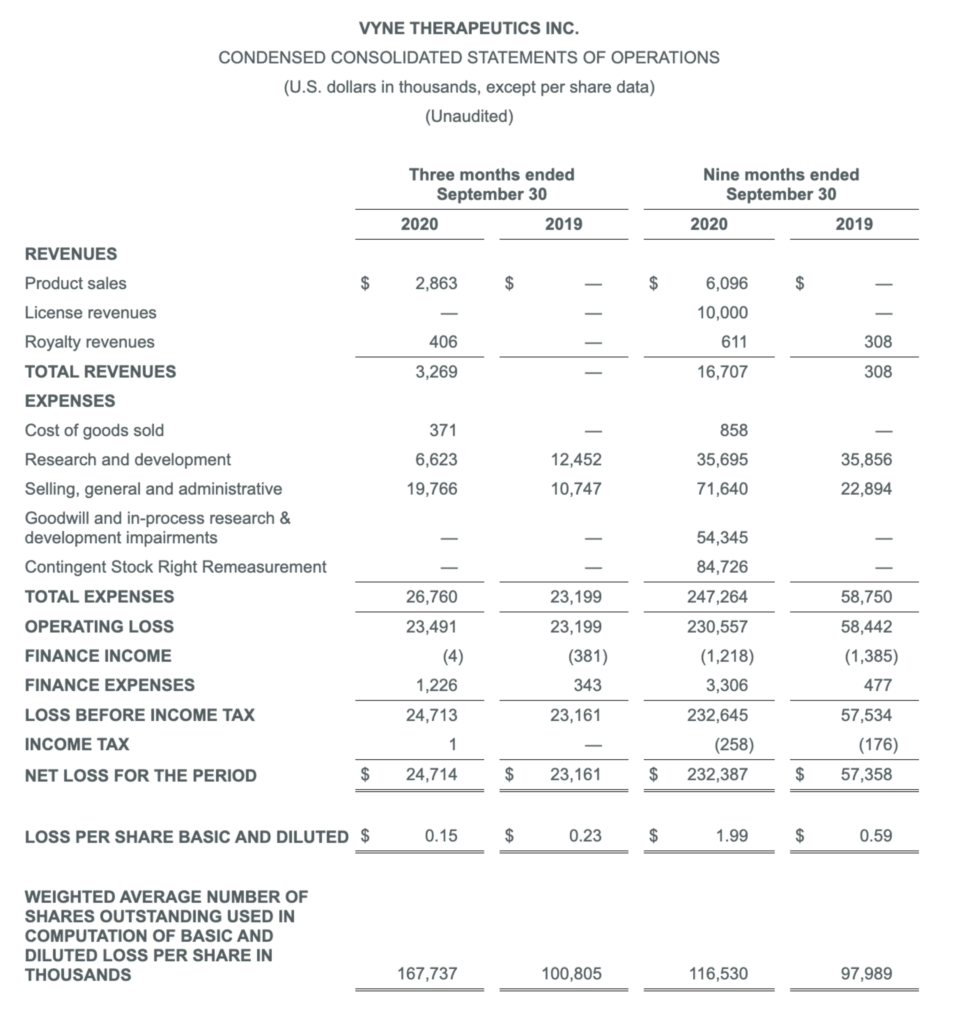

Financial Results for the Third Quarter Ended September 30, 2020

Revenues

Revenues totaled $3.3 million for the three months ended September 30, 2020. There were no revenues for the three months ended September 30, 2019. For the three months ended September 30, 2020, our revenues consisted of $2.9 million of product sales primarily associated with AMZEEQ, which was launched in January 2020, and $0.4 million of royalty revenue.

Cost of Goods Sold

Cost of goods sold was $0.4 million for the three months ended September 30, 2020. There was no cost of goods sold in the three months ended September 30, 2019 because the revenues in that period consisted solely of royalties, which do not bear related cost of goods sold.

Our gross margin percentage of 87% was favorably impacted during the three months ended September 30, 2020 by product sales with certain materials produced prior to FDA approval and therefore expensed in prior periods. If inventory sold during the three months ended September 30, 2020 was valued at cost, our gross margin for the period then ended would have been 85%.

Research and Development Expenses

Our research and development expenses for the three months ended September 30, 2020 were $6.6 million, representing a decrease of $5.8 million, or 47%, compared to $12.5 million for the three months ended September 30, 2019. Employee-related expenses decreased by $1.7 million. Clinical and manufacturing costs related to AMZEEQ and ZILXI decreased by $4.1 million.

Selling, General and Administrative Expenses

Our selling, general and administrative expenses for the three months ended September 30, 2020 were $19.8 million, representing an increase of $9.0 million, or 84%, compared to $10.7 million for the three months ended September 30, 2019. Employee-related expenses increased by $3.7 million, primarily due to the expansion of our employee base, including sales force, to support the growth of our operations and including stock based compensation. Sales and marketing expense increased by $5.3 million related to the commercialization of AMZEEQ and ZILXI.

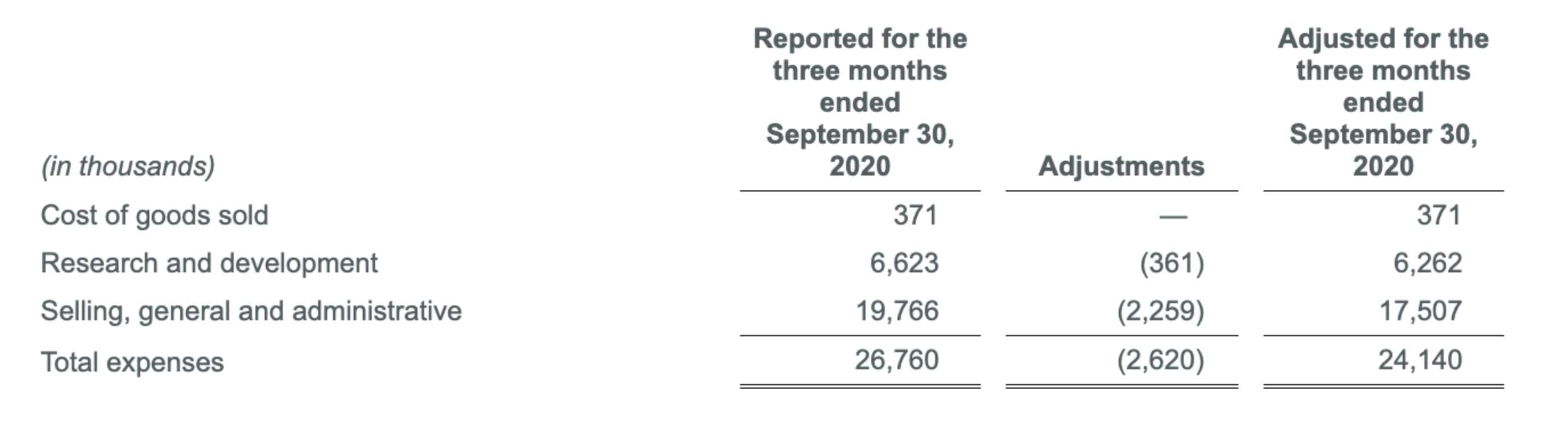

Total Expenses Adjusted for stock based compensation*

Set forth below is a presentation of our total operating expenses for the three months ended September 30, 2020, adjusted to exclude certain non-cash expenses incurred during the period. The adjustments below reflect non-cash expenses of stock based compensation. We believe that the adjusted operating expenses are important measures as they better reflect the ongoing operations of the Company and exclude certain non-cash expenses.

* Adjusted results are non-GAAP financial measures. See “Note Regarding the Use of Non-GAAP Financial Measures” elsewhere in this earnings release.

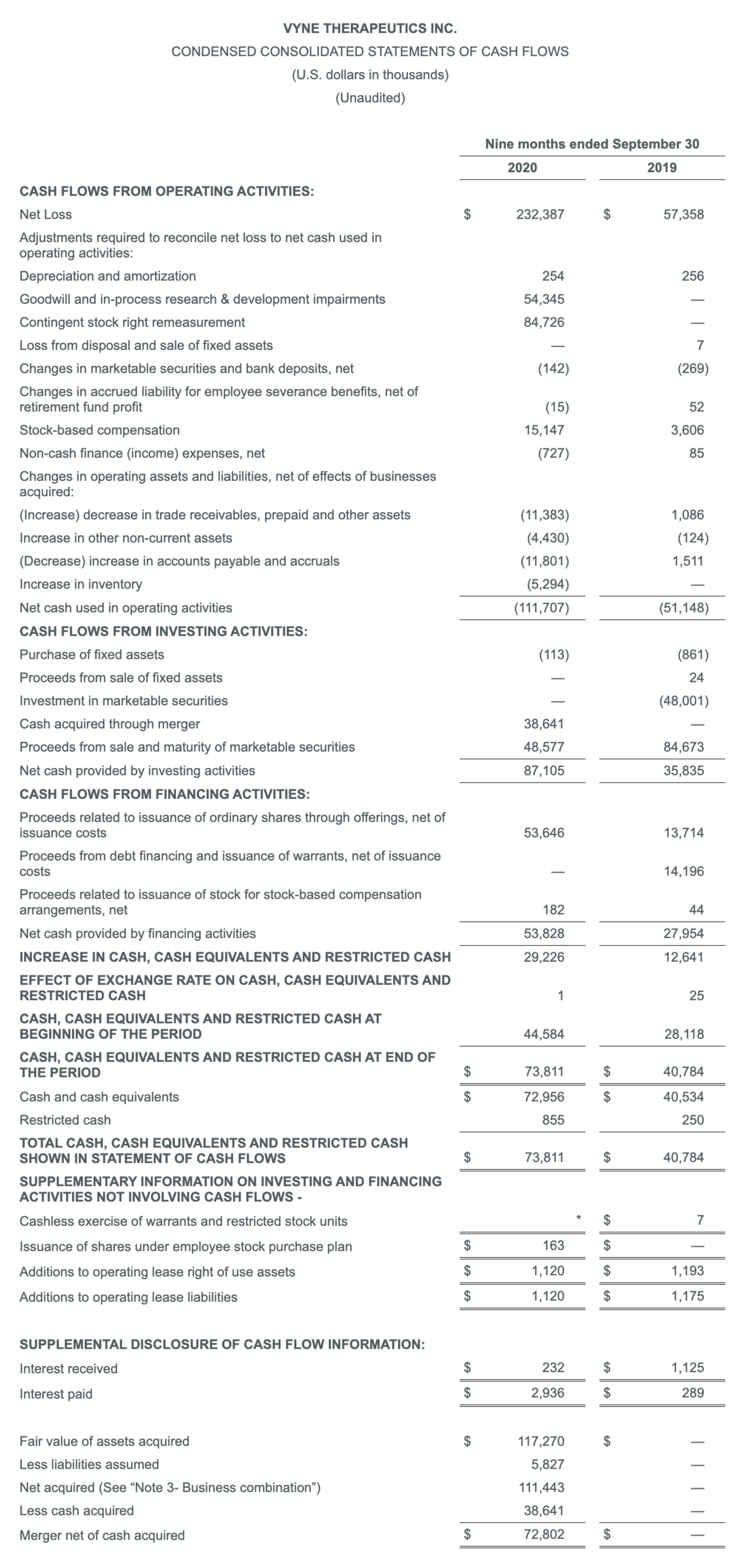

Cash & Cash Equivalents

As of September 30, 2020, VYNE had cash, cash equivalents and investments of $76.9 million. We believe that our cash and cash equivalents and investments and projected cash flows from revenues will provide sufficient resources for our current ongoing needs through December 31, 2021.

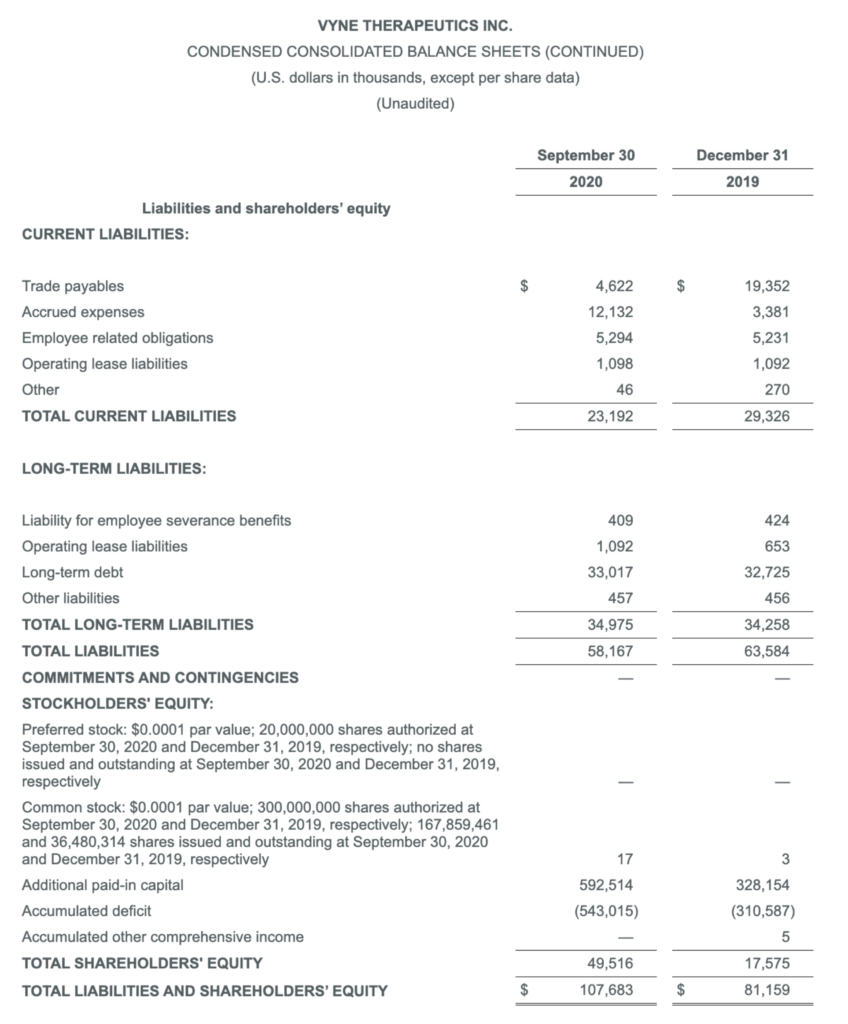

Financial Results for the Nine Months Ended September 30, 2020

Revenues

Revenues totaled $16.7 million and $0.3 million for the nine months ended September 30, 2020 and 2019, respectively. For the nine months ended September 30, 2020, our revenue consisted of $6.1 million of product sales, primarily associated with AMZEEQ, which was launched in January 2020, $10.0 million of license revenue, and $0.6 million of royalty revenue. For the nine months ended September 30, 2019, revenues consisted solely of royalty revenues. The increase in license revenue for the nine months ended September 30, 2020 as compared to license revenue for the nine months ended September 30, 2019 is due to the upfront payment received under the Cutia license agreement for the marketing and sale of our topical minocycline products in China.

Cost of Goods Sold

Cost of goods sold was $0.9 million for the nine months ended September 30, 2020. There was no cost of goods sold in the nine months ended September 30, 2019 because the revenues in that period consisted solely of royalties, which do not bear related cost of goods sold.

Our gross margin percentage of 86% was favorably impacted during the nine months ended September 30, 2020 by product sales with certain materials produced prior to FDA approval and therefore expensed in prior periods. If inventory sold during the nine months ended September 30, 2020 was valued at cost, our gross margin for the period then ended would have been 82%.

Research and Development Expenses

Our research and development expenses for the nine months ended September 30, 2020 were $35.7 million, representing a decrease of $0.2 million, compared to $35.9 million for the nine months ended September 30, 2019. Clinical and manufacturing expense for AMZEEQ and ZILXI decreased by $14.1 million. This was offset by an increase of $7.1 million of clinical costs related to serlopitant and employee-related expenses of $6.8 million, including $3.8 million related to severance expenses payable to our former employees, and stock based compensation of $2.8 million.

Selling, General and Administrative Expenses

Our selling, general and administrative expenses for the nine months ended September 30, 2020 were $71.6 million, representing an increase of $48.7 million, or 213%, compared to $22.9 million for the nine months ended September 30, 2019. Employee-related expenses increased by $24.9 million consisting of $13.3 million primarily due to the expansion of our employee base, including sales force to support the growth of our operations, $6.6 million of stock based compensation and $4.7 million of severance expenses payable to our former employees. Sales and marketing expenses increased by $16.1 million, related to the commercialization of AMZEEQ and ZILXI. We incurred $7.7 million expenses relating to the merger transaction between Foamix and Menlo included in selling, general and administrative expenses.

Goodwill and in-process research and development impairments

Goodwill and in-process research and development impairments for the nine months ended September 30, 2020 were $54.3 million. There were no impairments for the nine months ended September 30, 2019. In the nine months ended September 30, 2020, we recorded impairments of $4.0 million for goodwill and $50.3 million for in process research and development due to the failed clinical trials for serlopitant for the treatment of pruritus associated with prurigo nodularis.

CSR Remeasurement

Contingent Stock Right remeasurement for the nine months ended September 30, 2020 was $84.7 million. For the nine months ended September 30, 2020 we incurred $84.7 million of expense due to the remeasurement of the CSR to fair value which was driven by the result of the failed serlopitant trials. At the time of our merger transaction with Foamix, we entered into a contingent stock right agreement that called for the issuance of additional shares of our common stock to legacy Foamix shareholders upon negative data from both Phase 3 serlopitant trials. Since the trials did not meet the milestones outlined per the agreement, the contingent stock rights were remeasured, resulting in an expense of $84.7 million for the nine months ended September 30, 2020.

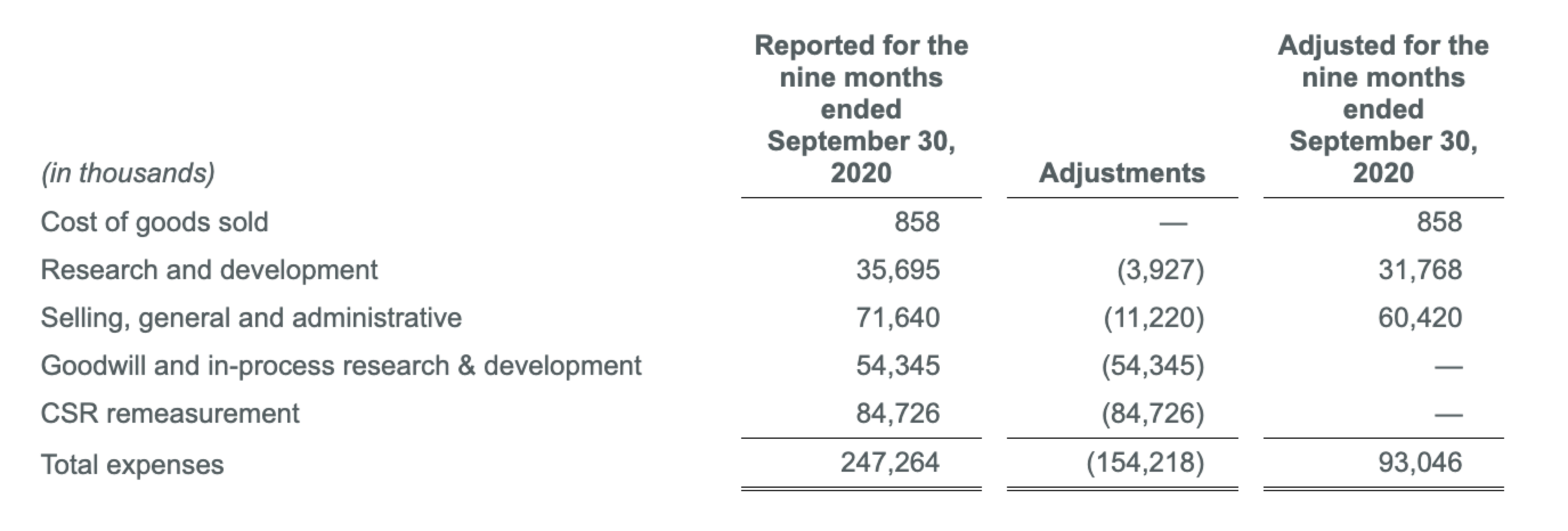

Total expenses adjusted for stock based compensation, CSR remeasurement and impairments*

Set forth below is a presentation of our total operating expenses for the nine months ended September 30, 2020, adjusted to exclude certain non-cash expenses incurred during the period. The adjustments below reflect non-cash expenses that we incurred during the period, mainly as a result of the merger transaction and the failed Phase 3 trials for serlopitant. Non-cash expenses for the nine months ended September 30, 2020 were $154.2 million, which included $84.7 million of contingent stock right remeasurement expense, $54.3 million goodwill and in-process research and development impairments, and $15.1 million of share based compensation expense. We believe that the adjusted operating expenses are important measures as they better reflect the ongoing operations of the Company and exclude certain non-cash expenses.

* Adjusted results are non-GAAP financial measures. See “Note Regarding the Use of Non-GAAP Financial Measures” elsewhere in this earnings release.

Conference Call

| Thursday November 5th @ 8:30am Eastern Time | |

| Toll Free: | 800-289-0438 |

| International: | 323-794-2423 |

| Conference ID: | 9576782 |

| Webcast: | http://public.viavid.com/index.php?id=142196 |

A replay of the call will be archived on the Company’s website at www.vynetherapeutics.com promptly after the conference call.

Note Regarding the Use of Non-GAAP Financial Measures

The Company has provided certain non-GAAP financial information as additional information to measure operating performance, including, among others, Adjusted Total Operating Expenses, Adjusted Net Loss, Adjusted Diluted Net Loss per Share and Adjusted EBITDA. The Company believes that its presentation of such non-GAAP measures provides useful information to management and investors regarding its financial condition and operations. Specifically, these measures exclude stock based compensation, CSR remeasurement and impairments of intangible assets. The Company does not believe that such expenses accurately reflect the Company’s ongoing operations, and the Company does not expect to incur similar expenses in future periods. These measures are not in accordance with, or an alternative for, generally accepted accounting principles in the United States (“GAAP”) and may be different from similarly titled non-GAAP measures reported by other companies. The Company has provided required reconciliations to the most comparable GAAP measures elsewhere in the document.

ZILXI and AMZEEQ Important Safety Information

Indications

ZILXI® (minocycline) topical foam, 1.5% is for the treatment of adults with pimples and bumps caused by a condition called rosacea. It is not known if ZILXI is safe and effective in children.

AMZEEQ® (minocycline) topical foam, 4% is for the treatment of pimples and red bumps (non-nodular inflammatory lesions) that happen with moderate to severe acne in patients 9 years age and older. It is not known if AMZEEQ is safe and effective in children under 9 years of age or older.

ZILXI and AMZEEQ are both topical forms of the antibiotic minocycline and are available by prescription only. ZILXI and AMZEEQ are for use on skin only (topical use). ZILXI and AMZEEQ are not for use in the mouth, eyes or vagina.

ZILXI and AMZEEQ should not be used for the treatment of infections.

Important Safety Information

- ZILXI or AMZEEQ should not be used in people who are allergic to ZILXI, AMZEEQ, or any tetracycline medicine. Use of ZILXI or AMZEEQ should be stopped right away if a rash or other allergic symptom occurs.

- ZILXI or AMZEEQ should not be used in women who are pregnant, may become pregnant or are nursing. If a woman becomes pregnant while using ZILXI or AMZEEQ, she should talk to her doctor. Tetracycline medicine when taken by mouth during pregnancy, infancy and/or childhood up to the age of 8 years may permanently discolor teeth (yellow-gray-brown) and may slow the growth of bones.

- ZILXI and AMZEEQ are flammable and fire, flame, and smoking must be avoided when applying and right after applying ZILXI or AMZEEQ.

- People should protect their skin from the sun while using ZILXI or AMZEEQ and avoid sunlight or artificial sunlight such as sunlamps or tanning beds. Use of ZILXI or AMZEEQ should be stopped if skin is sunburned.

- When taken by mouth, minocycline may cause feelings of lightheadedness, dizziness or spinning. People should not drive or operate dangerous machinery if they have these symptoms.

ZILXI and AMZEEQ are both topical foams that contain minocycline, a tetracycline medicine. They are not taken by mouth. However, tetracyclines, when taken by mouth (capsules or tablets), may cause serious side effects, including: diarrhea which may be caused by an infection and cause watery or bloody stools; loss of appetite; tiredness; yellowing of the skin or eyes (jaundice); bleeding more easily than normal; confusion; sleepiness; vision changes, including blurred vision, double vision, or permanent vision loss; unusual headaches; fever; rash; joint pain; body weakness; discoloration or darkening of the skin, scars, teeth, or gums. People should call their doctor right away if these side effects occur.

The most common side effect of ZILXI is diarrhea. The most common side effect of AMZEEQ is headache.

These are not all of the possible side effects for ZILXI or AMZEEQ. People should contact their doctor for medical advice about side effects and be sure to tell their doctor about all of their medical conditions and medicines they take before using ZILXI or AMZEEQ.

People are encouraged to report negative side effects of prescription drugs to the FDA. Visit www.fda.gov/medwatch or call 1-800-FDA-1088.

Please see full Prescribing Information for ZILXI and AMZEEQ.

About VYNE Therapeutics Inc.

In March 2020, Menlo Therapeutics Inc. (“Menlo”) and Foamix Pharmaceuticals Ltd. (“Foamix”) combined to form what is now known as VYNE Therapeutics Inc. VYNE’s mission is to improve the lives of patients by developing proprietary, innovative and differentiated therapies in dermatology and beyond.

With expertise in topical medicine innovation as a springboard, VYNE is working to develop and commercialize a variety of solutions using its proprietary Molecule Stabilizing Technology (MST™), and has received FDA approval for AMZEEQ® (minocycline) topical foam, 4%, the world’s first topical minocycline, and for ZILXI® (minocycline) topical foam, 1.5%, the first minocycline product of any kind to be approved by the FDA for use in rosacea. For more information about our approved products, please see AMZEEQ’s Full Prescribing Information at AMZEEQ.com and ZILXI’s Full Prescribing Information at ZILXI.com.

For more information about VYNE Therapeutics Inc. or its investigational products, visit www.vynetherapeutics.com or follow VYNE on Twitter. VYNE may use its website to comply with its disclosure obligations under Regulation FD. Therefore, investors should monitor VYNE’s website in addition to following its press releases, filings with the U.S. Securities and Exchange Commission, public conference calls, and webcasts.

Media Relations:

Bridgette Potratz

Zeno Group

312-358-2950

bridgette.potratz@zenogroup.com

Investor Relations:

Joyce Allaire

LifeSci Advisors, LLC

646-889-1200

jallaire@lifesciadvisors.com

Andrew Saik

Chief Financial Officer

VYNE Therapeutics

908-731-6180

Andrew.Saik@vynetx.com

Cautionary Statement Regarding Forward-Looking Statements

This release includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, but not limited to, statements regarding the development and commercialization of VYNE’s products and product candidates and other statements regarding the future expectations, plans and prospects of VYNE. All statements in this press release which are not historical facts are forward-looking statements. Any forward-looking statements are based on VYNE’s current knowledge and its present beliefs and expectations regarding possible future events and are subject to risks, uncertainties and assumptions that could cause actual results to differ materially and adversely from those set forth or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to: the COVID-19 pandemic and its impact on our business operations and liquidity; adverse events associated with the commercialization of AMZEEQ and ZILXI; the outcome and cost of clinical trials for current and future product candidates; determination by the FDA that results from VYNE’s clinical trials are not sufficient to support registration or marketing approval of product candidates; the outcome of pricing, coverage and reimbursement negotiations with third party payors for AMZEEQ, ZILXI or any other products or product candidates that VYNE may commercialize in the future; whether, and to what extent, third party payors impose additional requirements before approving AMZEEQ and ZILXI prescription reimbursement; the eligible patient base and commercial potential of AMZEEQ, ZILXI or any of VYNE’s other products or product candidates; risks that VYNE’s intellectual property rights, such as patents, may fail to provide adequate protection, may be challenged and one or more claims may be revoked or interpreted narrowly or will not be infringed; risks that any of VYNE’s patents may be held to be narrowed, invalid or unenforceable or one or more of VYNE’s patent applications may not be granted and potential competitors may also seek to design around VYNE’s granted patents or patent applications; additional competition in the acne and dermatology markets; risks related to our indebtedness; inability to raise additional capital on favorable terms or at all; VYNE’s ability to recruit and retain key employees; and VYNE’s ability to stay in compliance with applicable laws, rules and regulations. For a discussion of other risks and uncertainties, and other important factors, any of which could cause VYNE’s actual results to differ from those contained in the forward-looking statements, see the section titled “Risk Factors” in VYNE’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2020, as well as discussions of potential risks, uncertainties, and other important factors in VYNE’s subsequent filings with the U.S. Securities and Exchange Commission. Although VYNE believes these forward-looking statements are reasonable, they speak only as of the date of this announcement and VYNE undertakes no obligation to update publicly such forward-looking statements to reflect subsequent events or circumstances, except as otherwise required by law. Given these risks and uncertainties, you should not rely upon forward-looking statements as predictions of future events.

* Represents an amount less than one thousand

Non-GAAP Financial Measures

The following tables reconcile non-GAAP financial measures presented in this press release or that may be presented on the Company’s third quarter conference call with analysts and investors. The Company believes that these non-GAAP financial measures provide management, analysts, investors and other users of the Company’s financial information with meaningful supplemental information regarding the performance of the Company’s business. These non-GAAP financial measures should not be considered superior to, but in addition to other financial measures prepared by the Company in accordance with GAAP, including the year-to-year results. The Company’s method of determining these non-GAAP financial measures may be different from other companies’ methods and, therefore, may not be comparable to those used by other companies and the Company does not recommend the sole use of these non-GAAP measures to assess its financial and earnings performance. For reasons noted above, the Company is presenting certain non-GAAP financial measures for its fiscal 2020 third quarter. In order for investors to be able to more easily compare the Company’s performance across periods, the Company has included comparable reconciliations for the 2019 period in the reconciliation tables below.

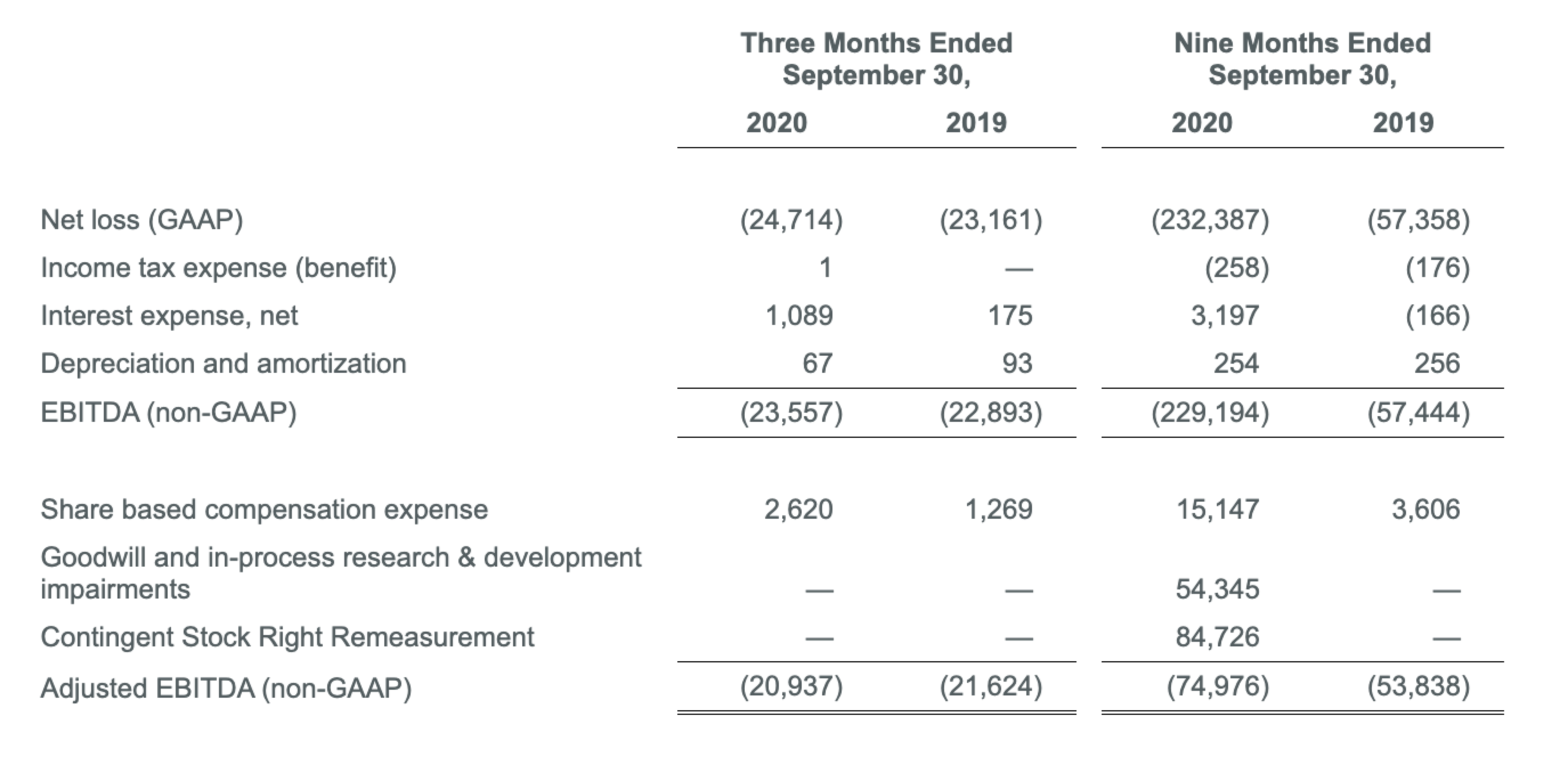

Reconciliation of EBITDA and Adjusted EBITDA (non-GAAP)

The following table provides a reconciliation of Net loss (GAAP) to Adjusted EBITDA (non-GAAP) for the three and nine months ended September 30, 2020 and 2019 (in thousands):

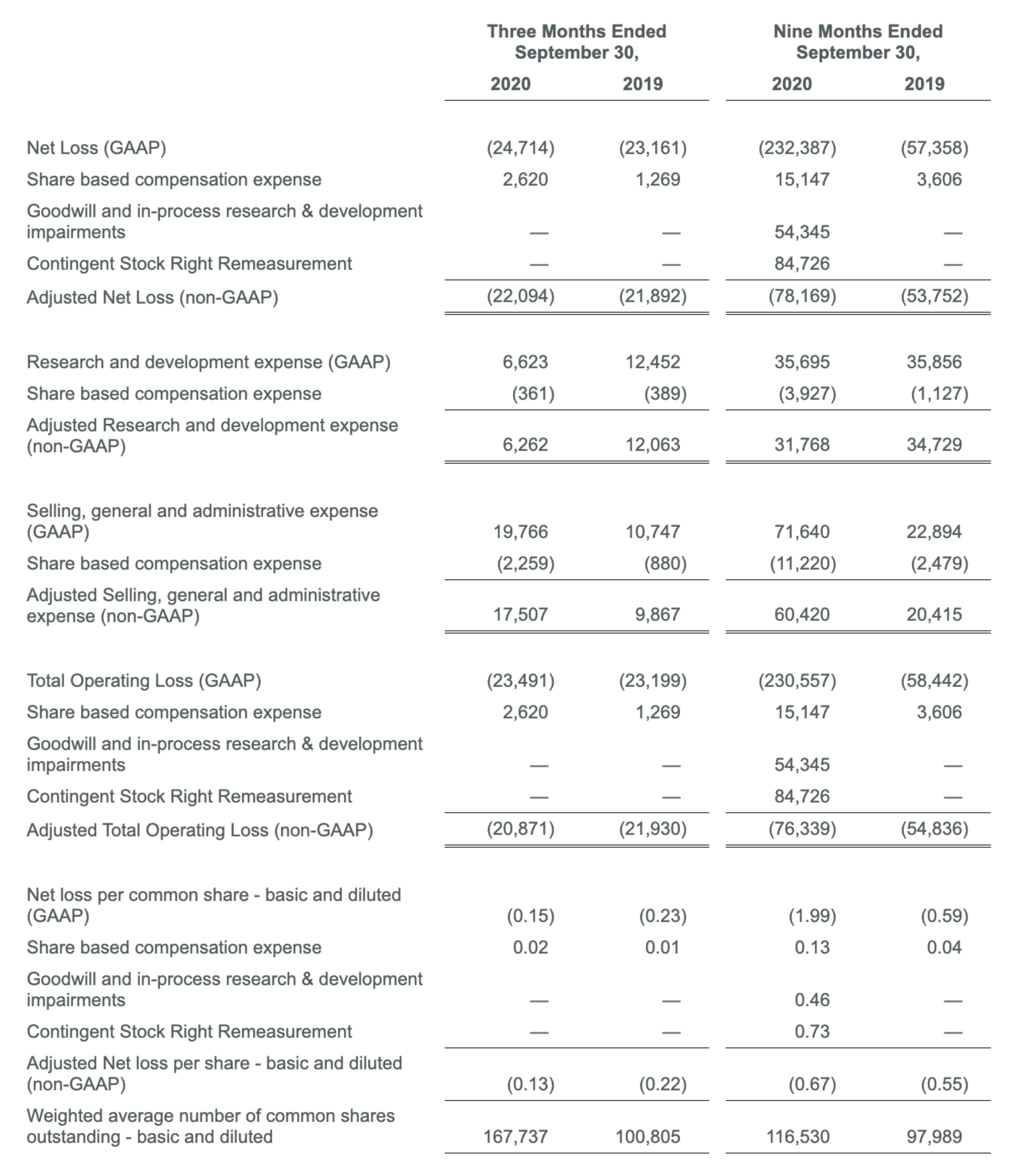

Reconciliation of Net Loss and Adjusted Net Loss (non-GAAP)

The following tables provide detailed reconciliations of various other income statement data between GAAP and non-GAAP amounts for the three and nine months ended September 30, 2020 and 2019 (in thousands, except per share data):